Syndicated Property Program

Overview

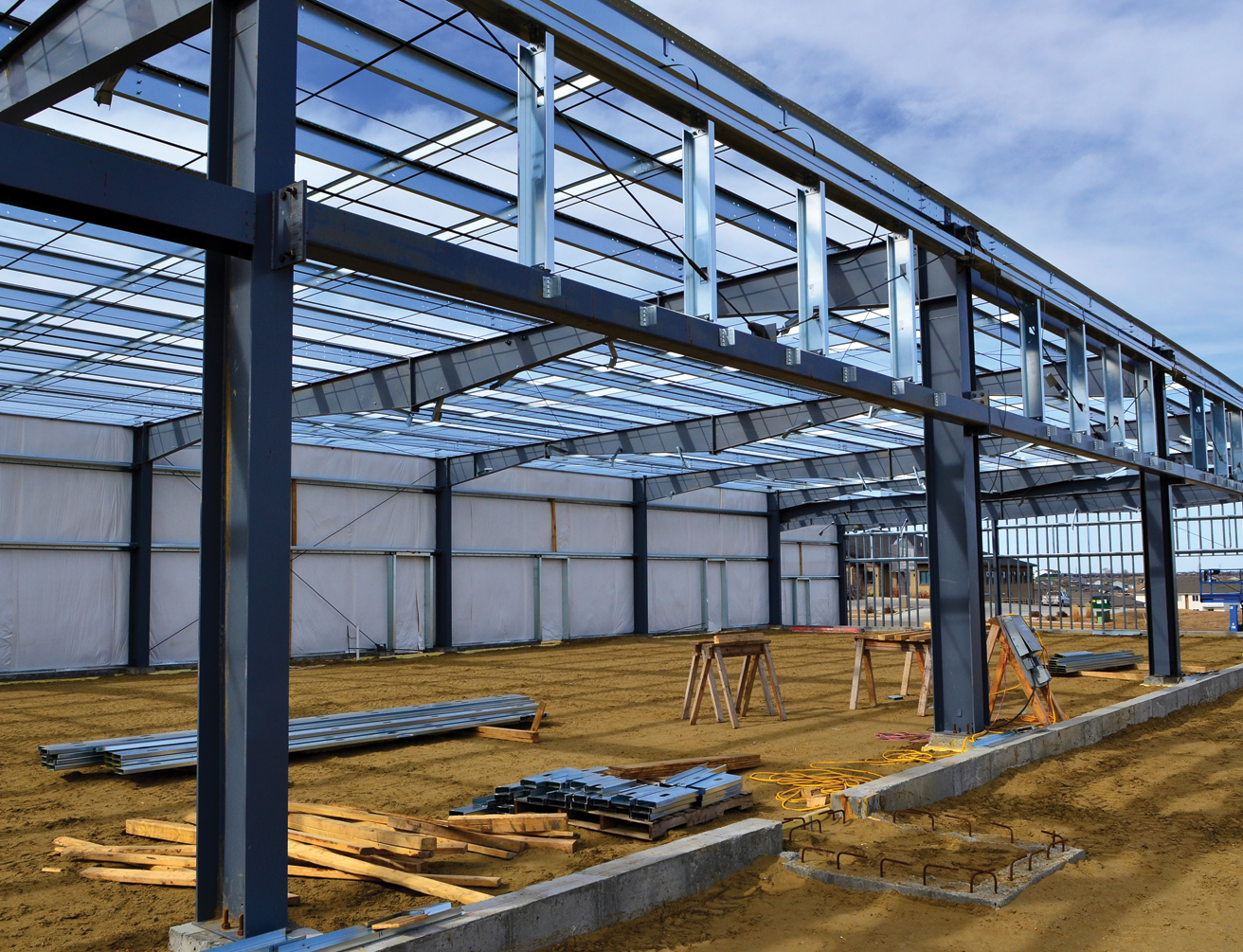

As industrial processes become increasingly complex and inherently volatile, the need for specialty property insurance capacity is in high demand yet supply is often frustratingly sparse.

Jupiter Risk Services delivers flexible risk transfer solutions for high-hazard risks typically declined or restricted by traditional, cookie-cutter insurance carriers.

Clients would generally have robust risk management controls in place, but key locations may have sprinkler deficiencies and the absence of other physical loss prevention measures that may limit being classified as highly protected.

Target Occupancies

All occupancies will be considered, including real estate and hospitality; however, target risks primarily create, store, transport, or distribute high-hazard products and materials (raw and finished), including but not limited to:

Excluded Occupancies

Risks outside of appetite include occupancies associated with the production and distribution of energy, oil and gas extraction and production, including nuclear (hot/cold), renewables, gas/coal/wind/solar power, upstream/midstream/downstream, and any offshore risk.

Additional excluded occupancies include:

Status & Distribution

Jupiter Risk Services is a Managing General Underwriter and utilizes Amherst Specialty Insurance Company operating as a non-admitted excess & surplus lines insurance company, rated A- VIII (excellent) by AM Best. Jupiter Risk Services is accessible via retail and select wholesale brokers.